There’s no mystery behind the growth in discount cards, cash pharmacies and other options for purchasing prescriptions without insurance. Consumers like choices, especially choices that can save them money.

Consumers aren’t the only ones who save. Anytime someone with pharmacy benefits goes the non-insurance route, their health plan usually never pays a single penny. Almost like it never happened.

The problem is, health plans and plan sponsors want to know it happened. For a variety of reasons, they like knowing a member is taking a medication as prescribed. And they do—when the purchase is made using insurance. Not so when a prescription is purchased with a discount card or at a pharmacy’s cash price (without insurance).

Like everything in pharmacy, it seems, what should be a simple win-win scenario for patients and payers can get complicated. But it doesn’t have to.

Making a Claim for Prescriptions without Insurance

Many people with prescription benefits already use non-insurance options at least some of the time, whether for cost savings or sheer convenience. For patients without insurance, cash pharmacies and discount cards are likely the only options for medication access.

GoodRx states that its discount card prices beat insurance prices for 40% of the 100 most-prescribed drugs in the U.S. Countless news stories have cited wide disparities that can exist between a patient’s out-of-pocket cost with insurance and the cash price for certain drugs.

If non-insurance options can make some medications more affordable—and thus easier for patients to stay on without interruption—why wouldn’t health plans and plan sponsors offer them to members, especially when such options reduce plan spend? Reasons can vary among different plans, but most revolve around data, or lack thereof.

Missing Out on Missing Data

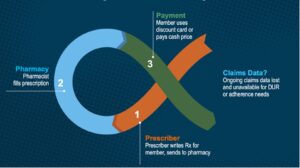

The conventional data loop from prescriber to pharmacy to payer happens every time a plan member gets their medication at the negotiated insurance price, because the claim is adjudicated through the plan’s PBM. Pharmacy claims data verify that prescriptions are filled.

When members pay a cash price or use discount cards, their plans typically have no record of it. Plans lose that valuable claims data, whether they’re monitoring adherence and utilization or tracking financial trends.

Missing claims can also be an issue for members. While lower prescription costs are helpful in the near term, they can keep someone in a cost-sharing phase longer. If the member’s plan reimburses non-insurance purchases, they’ll need to file the receipts and submit claims after every fill. If healthcare expenses come into play at tax time, the required documentation might be in several different places.

What’s more, when a member goes “off plan,” they may lose visibility into perfectly good clinical alternatives that have lower costs through insurance than their current drug’s cost with and without insurance.

A Solution in Real Time

Why can’t pharmacies report cash price and discount card claims back to health plans, especially if a pharmacy has a customer’s insurance information on file? The answer is… complicated. But it can be done.

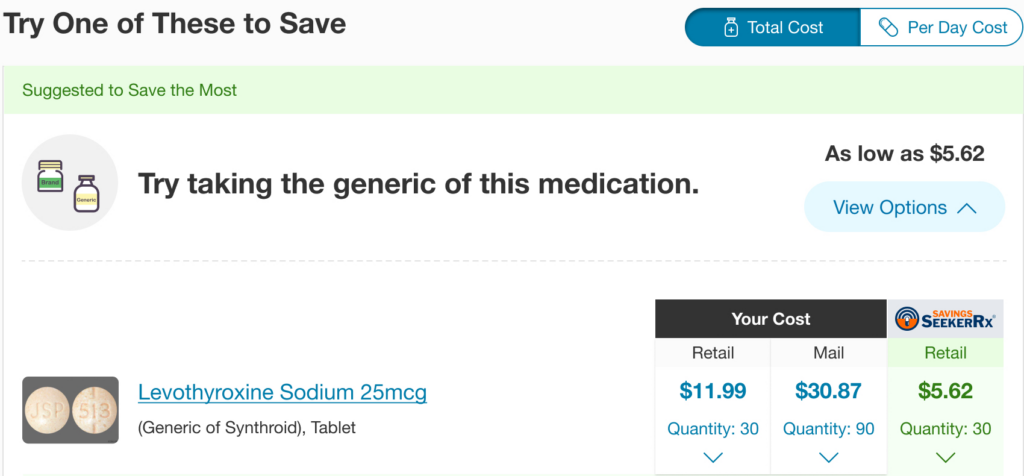

How can members know for sure what their lowest-cost options are—insurance vs. discount card vs. a cash pharmacy—when the cost equation can change between fills and pharmacies? That’s also possible, and even simpler.

All it takes is a solution that allows a member to compare cash or discount card prices to their insurance options in real time. It should also capture the claim from whichever option they choose.

Plans can now integrate discount cards, cash pharmacies and other non-insurance offerings into the core RxSS solution, which will:

- Compare eligible, funded benefit claims to cash discount offers in real time and return paid claims to pharmacies with the lowest out-of-pocket cost for the member

- Deliver claim details to the plan’s PBM for comprehensive tracking and adherence monitoring (with member consent)

- Send data back to the plan if non-insurance claims are applicable to the member’s deductible

Not every health plan or plan sponsor will jump in overnight, but they can move ahead of the curve to meet increasing member demand for the growing number of non-insurance options. In recent years, many payers have realized the benefits of providing cost and clinical transparency to their members. Payment and fulfillment transparency adds another positive dimension.

Cash pharmacies and discount cards are here to stay. Why not make them a win-win for patients and payers?