The increasing popularity, utilization and cost of GLP-1 and related drugs has been the story of pharmacy benefits since 2023. How did we get here, what are payers thinking and doing about it, and how can Rx Savings Solutions help their GLP-1 coverage and cost strategies?

Back in 2022 , the pharmacist team at Rx Savings Solutions (RxSS) noticed a serious uptick in members searching for injectable diabetes medications in the RxSS member portal and mobile app. Various dosages of Ozempic®, Mounjaro®, Wegovy® and Saxenda® comprised the seven most-searched drugs in our lookup tool. Together they dwarfed the next-closest drug class (ADHD).

By now most people know that GLP-1 (glucagon-like peptide agonist) drugs activate receptors of the intestinal GLP-1 hormone, causing the stomach to empty more slowly after eating and signal to the brain that it’s full. Originally developed for treatment of Type 2 diabetes (T2D), many patients reported appetite and weight reductions, and utilization soon skyrocketed for people with and without T2D.

Through Q1 2024, they’re still by far the most-searched drugs by RxSS members—and no doubt among the broader population, too. Prescriptions for weight loss and T2D continue trending upward. J.P. Morgan Research forecasts patients on GLP-1s could exceed 30 million in the U.S. alone by the end of the decade.

[“The increase in appetite for obesity drugs.” J.P. Morgan Global Research, 29 Nov. 2023. Accessed April 16, 2024.]

GLP-1s – Past, Present and Future

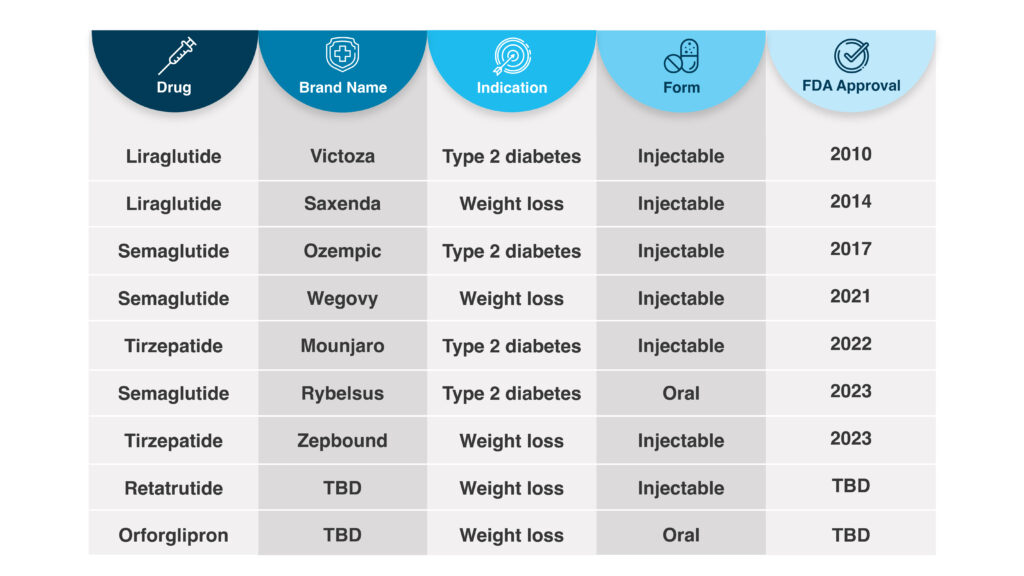

Given the recent craze, it may surprise some that the GLP-1 drug Saxenda (liraglutide) was approved by the FDA for weight reduction in people without T2D 10 years ago. In 2021, Wegovy (semaglutide) became the other GLP-1 approved for weight loss, although its lower-dose sibling Ozempic was approved for diabetes in 2017. Wegovy is now indicated for reduction of cardiovascular event, which means some payers that previously did not cover the drug for obesity now cover it for cardiovascular disease.

[FDA News Release, March 8, 2024. Accessed May 9, 2024.]

Approved for weight loss in November 2023 under the name Zepbound®, tirzepatide was approved as the diabetes drug Mounjaro in 2022. Like Ozempic and others approved for diabetes, Mounjaro was often prescribed off-label to patients for weight loss.

However, unlike Ozempic and Wegovy’s active ingredient, tirzepatide works on a second hormone receptor, GIP (glucose-dependent insulinotropic polypeptide), which some studies suggest is more effective than semaglutide for blood sugar control and weight loss. A triple-hormone-receptor agonist, retatrutide, awaits FDA approval.

Nearly all these medications are administered by weekly injection, though there is one semaglutide oral tablet (Rybelsus) approved for diabetes. Other oral are in FDA review and could hit the market in 2024.

GLP-1 Coverage and Cost Considerations

List prices for these drugs range from $700 to $1,400 for a 30-day supply (four injections). Even when netted out for rebates and payment assistance, a year of treatment can approach five figures. The U.S. population has a 34% prevalence of obesity and 11% for diabetes (overwhelmingly Type 2). No wonder payers are concerned about the short- and long-term costs.

Earlier in 2023, RxSS looked at 80 clients’ employer-sponsored plans over a 90-day span. The plans we analyzed averaged twice as many GLP-1 claims versus the same period in 2022. The uptick translated to an average plan-wide spend increase of $4.48 per member, per month!

[RxSS data; Feb.-April 2022 and 2023; total GLP-1 claims for 80-client sample.]

In the Employer Health Innovation Roundtable (EHIR) Diabetes and Weight Management report, benefits decision-makers at 62 member organizations were surveyed in June 2023. Their organizations range in size from 1,800 to 1.5 million employees. Topics included cost, coverage, and concerns related to diabetes and weight-loss drugs.

Within the findings were several considerations for patients and payers:

- High costs for GLP-1 medications ranked as respondents’ top concern (followed by lack of control over who is prescribed the medications)

- 93% covered GLP-1s for management of diabetes in the previous plan year; 56% also covered for weight loss

- Among those that cover GLP-1s, 77% follow their PBM’s authorization criteria when the medications are prescribed to manage diabetes; 79% do so when prescribed for obesity

- 27% of respondent plans that cover for diabetes have utilization management programs in place; for obesity, 17% require a behavior change program as a prerequisite for coverage

- 94% of all respondents believe utilization will increase over the next three years

Navigating GLP-1, Diabetes and Obesity Costs

Without getting into efficacy of individual drugs, as a class they improve glycemic control for patients with T2D and reduce body mass index (BMI) between 7% and 16% in a year (+/- a few months). More time and clinical studies are needed to determine whatever long-term health benefits and cost avoidance result from prescribing and covering these drugs for weight loss.

In 2024, many plans moved to offset spend from an expected jump in claims. Some now cover GLP-1s only with a diabetes diagnosis. Others may require lifestyle modification programs before or with GLP-1 coverage for weight loss. If a plan did not require prior authorization previously, there is a good chance it does now.

How RxSS Can Help

Every plan may approach these drugs differently, but it is clear more members will need help with affordability and access. RxSS can optimize any strategy for the plan and member.

GLP-1/GIPs sit in our core solution like any other medications adjudicated on the pharmacy benefit. The RxSS platform includes 228 total for weight-loss medications and 110 for GLP-1s. For T2D indications, RxSS has 80 suggestions related to semaglutide, liraglutide and tirzepatide.

RxSS identifies savings opportunities according to the drugs a plan covers, an individual member’s plan design and current deductible. Members are notified proactively anytime a lower-cost (or easier-to-source) option is available. If they wish, RxSS can facilitate approval from their prescriber. In other words, the platform works with GLP-1s and related therapies like it does any prescription a member takes.

GLP-1 Coverage and Cost Transparency for Members and Plans

The GLP-1 boom illustrates how difficult it can be to predict and prepare for a sudden surge in utilization and costly claims, or the next shortage. The most reliable defense is using every available measure to reduce spend across the pharmacy benefit. More than ever, plans will benefit from providing transparency to covered members regarding clinical alternatives and effective, lower-cost treatment options.

When members are empowered with actionable information, more medication decisions can be informed rather than influenced.