Director of Specialty Pharmacy at Rx Savings Solutions, Bryan Schuessler, PharmD, MS, CSP breaks down the opportunity cost of specialty copay programs.

Utilization of specialty medications continues to rise, and so do costs for patients and plan sponsors.

According to PSG’s Artemetrx Specialty Report, a patient’s monthly cost for specialty therapy increased 27% from 2018 to 2020. Specialty utilization under the pharmacy benefit (not medical) rose 2.8% from 2019 to 2020. These and other trends have the market scrambling to keep specialty costs in check as part of an overall strategy to mitigate pharmacy spend.

Manufacturer copay assistance importantly shields many patients from the often exorbitant out-of-pocket costs. However, copay assistance can have unintended consequences for a plan sponsor’s existing benefit design. In response, many sponsors have turned to copay adjustment programs to help ensure the stability of their pharmacy offerings. These programs typically fall into one of two categories:

Specialty Copay Accumulator Programs

- Allow utilization of copay cards

- Do not apply copay card values toward a member’s deductible

- Can exhaust the copay card funds at any point in a calendar year

- 2021 research showed that 43% of covered lives were in a plan that implemented an accumulator program, but popularity seems to be on the decline due to patient disruption and opposition

Specialty Copay Maximizer Programs

- Allow utilization of copay cards and typically operate with third parties

- Do not apply copay card values toward a member’s deductible

- Calculate copay funds to last a calendar year

- More common than accumulator programs in 2021 with increasing use

Given the growing prevalence of copay programs—more than 30% of our clients are using maximizers this year—it’s crucial to understand how they fit into your benefit and where they improve or hinder your plan. Let’s look at some examples of what to watch for when implementing these copay programs.

For Comparison’s Sake

Here’s a common copay adjustment scenario, and how the outcomes differ between program types. Assume the following:

- Inflammatory drug costs $21,000 (not including rebates or discounts)

- Copay card has $12,000 annual limit

- Member has 28% co-insurance until their $2,800 deductible is met, then pays $100 for preferred specialty products

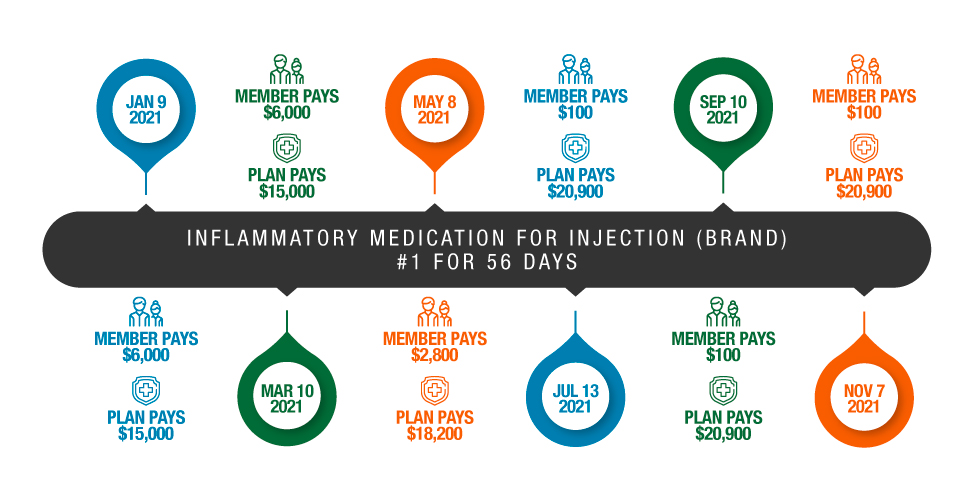

Accumulator Example

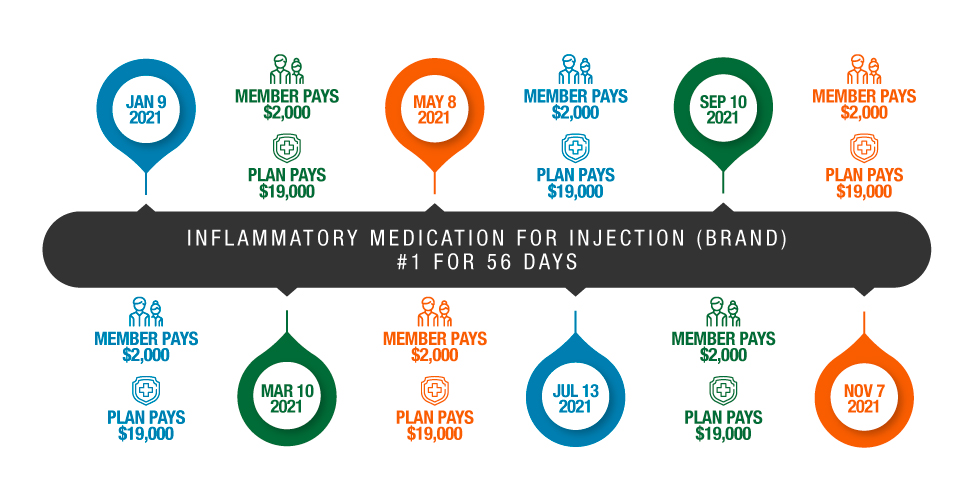

Maximizer Example

In each example the manufacturer’s financial aid is used to offset plan expenses. However, member impact varies greatly in the accumulator and maximizer scenarios.

In the accumulator example, the patient is faced with an out-of-pocket spend upon the third fill, requiring their entire deductible to be paid before the medication can be dispensed. According to IQVIA, this surprise copay scenario results in a 13x jump in discontinuation rate. Opposition to these programs led some states to introduce legislation designed to inhibit or prohibit them.

In the maximizer example, the patient never reaches their deductible because the financial aid is “adjusted” (spread out) in equal shares to cover the copays for every fill. IQIVA reports a 91% decrease in abandonment rate for immunology drugs when copay cards cover out-of-pocket expenses.

With that in mind, maximizer programs are less controversial between patients and their advocates as they don’t require eligible patients to pay anything out of pocket for their medication. However, both accumulator and maximizer programs are equally draining for pharmaceutical manufacturers who may already provide rebates to payers on top of patient-focused financial assistance for most of these drugs.

Copay Maximizer Misnomer

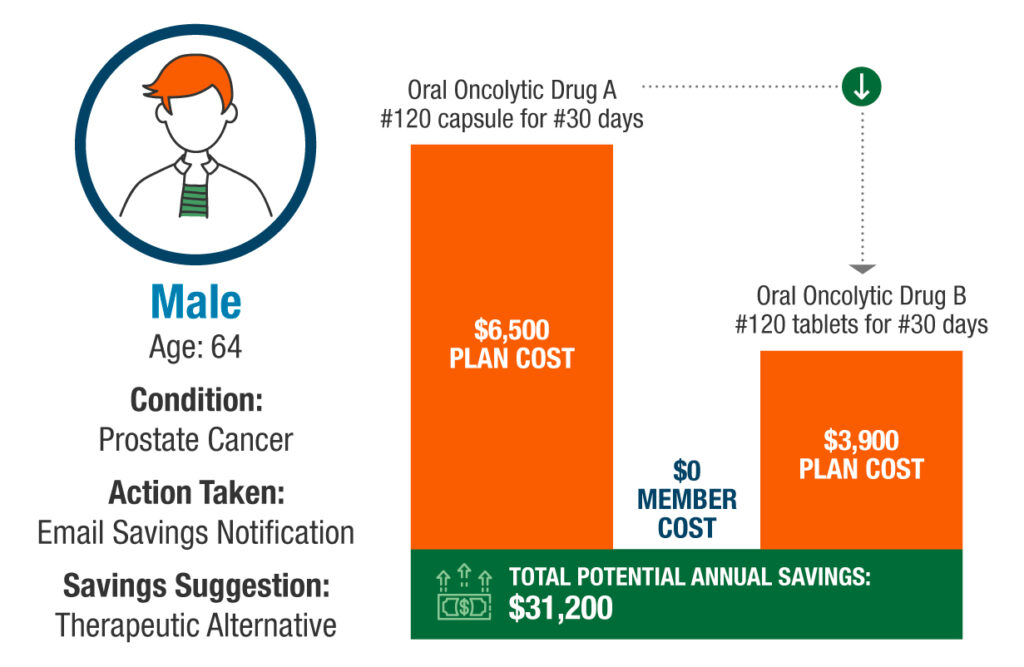

In this example a member is taking a brand name medication with no generic available. However, there is a potential therapeutic alternative in which a generic is available.

- The member fills the brand medication and has a ~$2,000-member copay and a plan cost of ~$6,500.

- The copay card has ~$25,000 on it so allows for a copay of a little over $2,000 a month. The results is no cost to the member throughout the 12 months and maintains consistent plan spend.

- However, there is a generic available which would result in the same cost to the member of $0 (as generics are given $0 copays in these copay maximizer designs) and the plan cost would reduce to ~$3,900 within the given plan design.

As plans continue to lean on copay maximizer programs, they also need to ensure they’re maximizing every savings opportunity available. That requires real-time analysis of claims and pricing to uncover the best options for plan sponsors and their members. And that just so happens to be what RxSS technology does 24/7.

————————————-

Want a deeper dive into Specialty Rx?

Access our latest on-demand webinar exploring trends in specialty Rx and strategies employers and health plans can use today to control their costs.

Learn More