Last week, a new member in Connecticut received her first emailed Savings Notification, registered her account, and immediately acted on our savings suggestion, an alternative that saves her nearly $660 per fill.1

The same day, a new member in Washington switched from a brand medication to a generic therapeutic alternative, saving $310 per monthly fill.2 His action was spurred by the third email in a four-touch, 7-week campaign that’s part of our standard employer launch plan.

Why did each engage when they did? Could be financial, foresight, curiosity, or some other trigger in the right place at the right time. What matters is that the information found these members where they were, and the members found us.

It’s our job to continually measure what works best for different people and populations—and to evolve the message and means of delivery, accordingly.

We know through experience that members respond to communication that is personalized, data-driven, timely and targeted. And we know it needs to arrive through their preferred channel—email, snail mail, text message or voice. The right mix can lead to incredible savings whenever a member is ready to engage.

A member in Georgia we spoke with last week underscores the value of persistent engagement:

“I don’t know why I had dismissed the emails before. But something told me I needed to try (Rx Savings Solutions). All I know is I decided to give them a call. The savings ($174.07 per fill) are huge, and I could have been saving all this time! There’s a vacation right there.”

Other times, it could mean the difference between filling or skipping a prescription for a chronic condition. Or paying the gas bill or not. Or being able to afford the upcoming holiday season.

Anytime a member has an opportunity to save, they should know about it. And they should always know a resource like Rx Savings Solutions is there for them. Every touchpoint counts. Every type of contact info improves the odds.

Because you never fully know what makes a member finally “click”—or when.

—

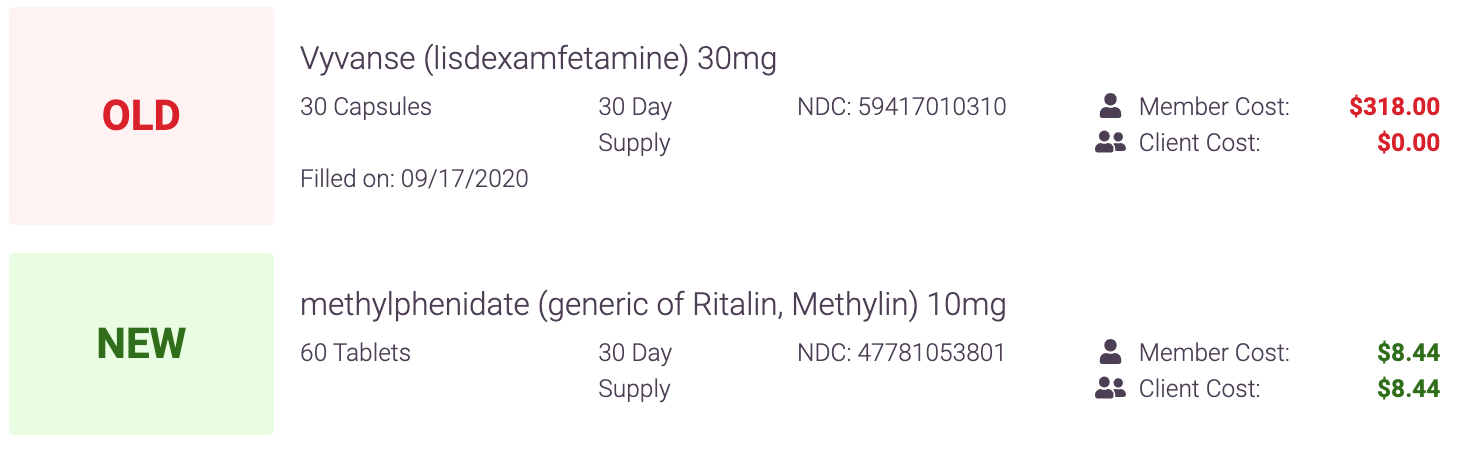

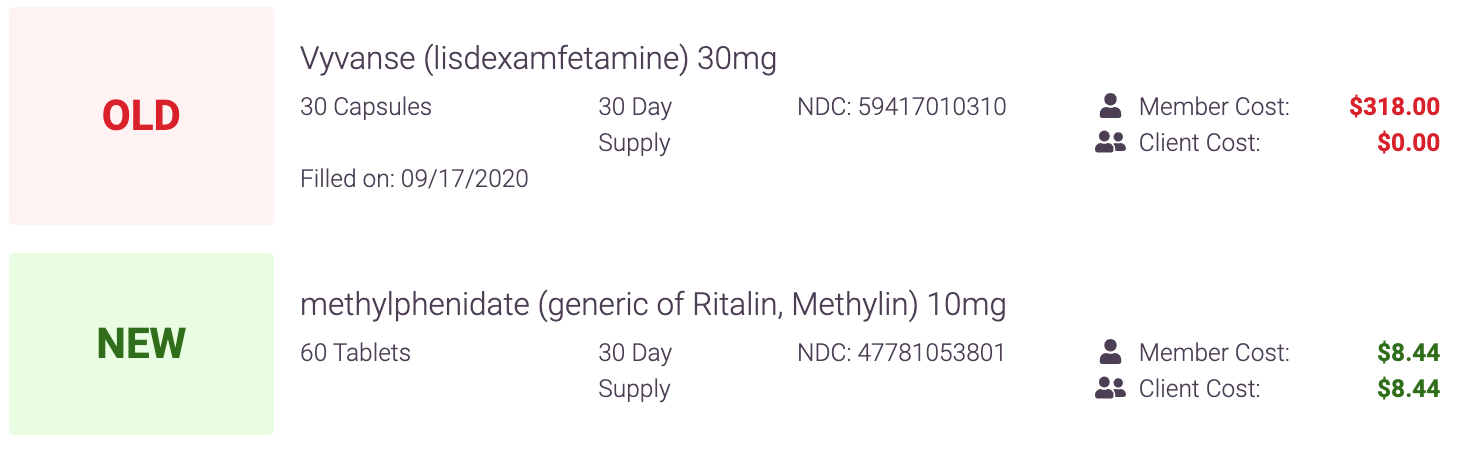

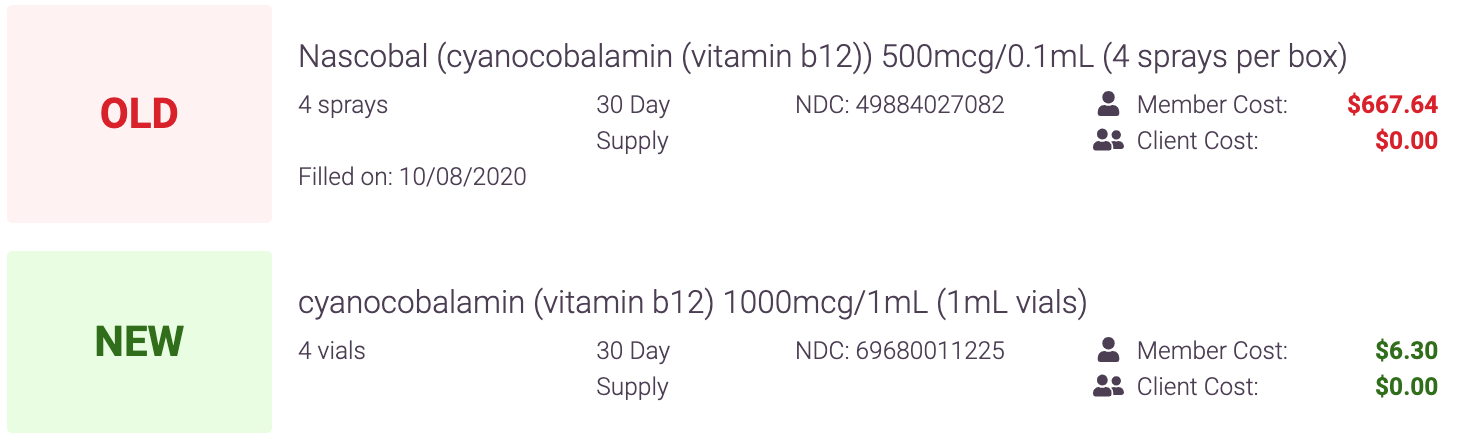

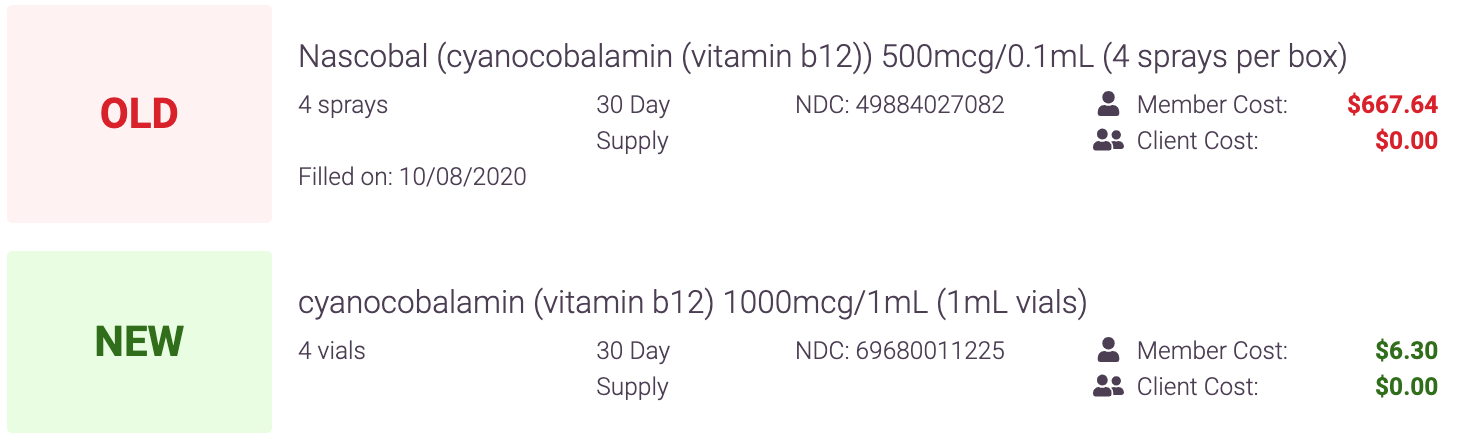

[Actual before-and-after member savings examples, referenced above]

1:

2: