It’s not every day you can learn what’s on the minds of benefits leaders from dozens of top U.S. employers. The Employer Health Innovation Roundtable (EHIR) does it on a regular basis, most recently on topics of transparency and cost savings in pharmacy benefits.

You may not know EHIR, but you would recognize its members. The 35-37 companies that took part in EHIR’s research report are household names across the industry spectrum, organizations with up to 400,000 employees.

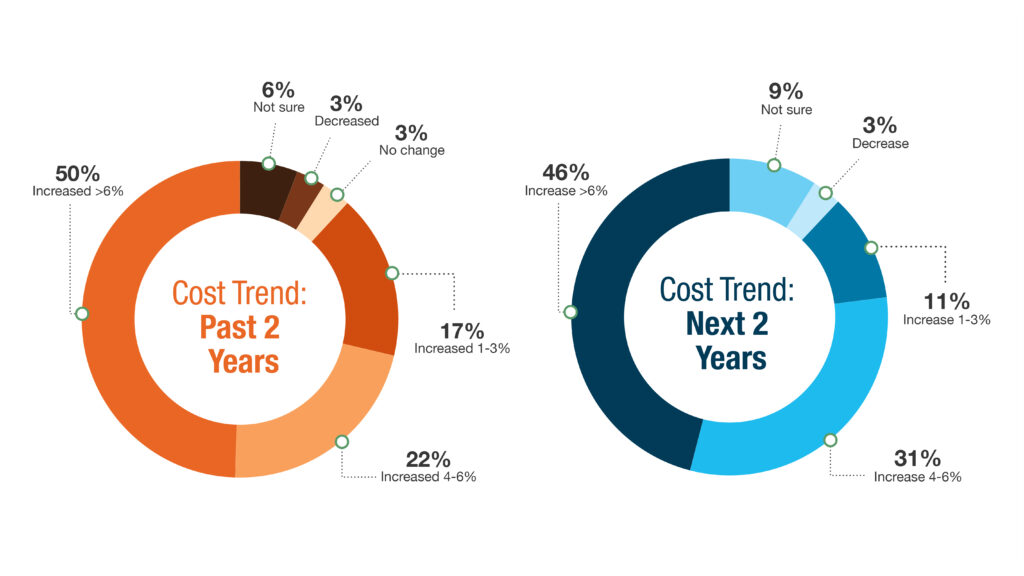

No breaking news here: Pharmacy cost trends continue to climb for these employers, and they expect more of the same.

Surprisingly, cost containment didn’t top the list of what these plan sponsors want their pharmacy benefits strategy to achieve. Let’s examine the top five priorities as determined by participant surveys and interviews.

1. Clinical outcomes

Employers recognize the need to balance multiple, often conflicting goals and values, namely the need to control rising costs but also support members with better medication access and affordability. The EHIR report conveyed employers’ inability to determine whether their growing pharmacy spend is improving members’ health and reducing downstream costs of care.

“Pharmacy is one of the fastest-growing areas of spend in benefits, yet it’s also the least clear and hardest area to set metrics for success,” stated one participant, contrasting it with the medical benefit “…where we look at outcomes metrics and total cost of care.”

A lack of transparency into drug costs, contracted prices, rebates and performance reporting add to the challenge. Participants expressed the desire for more and better data from PBMs and other stakeholders to better manage costs and improve health outcomes.

“We’re looking to transition from being drug-focused to member-focused, which would free us from needing to focus on things like maximizing rebates for a certain drug and instead focus on how to maximize the right care for the right patient,” said another benefits leader, touching on a secondary theme in the research: employers turning to innovators in the space to address data, cost transparency and clinical management gaps with traditional pharmacy players.

2. Cost sustainability

Respondents ranked it a close-second objective, but the underlying theme of the EHIR report is unsustainable cost trends and mounting employer frustration with the status quo.

Nearly every leader (97%) cited specialty drugs as a top-three cost driver; two in three named GLP-1s for diabetes and/or weight-loss treatment; and several (17%) expect cell and gene therapies to be top three by 2026. Many leaders expressed feeling powerless to control costs within the traditional pharmacy benefits management model (in use by 89% of the plans represented).

While a PBM might point to savings realized in one or more drug categories, “in reality they shift those ‘savings’ into another bucket,” said one benefits leader. “It feels like our hands are tied.”

Nevertheless, only 24% of respondents are considering a PBM change in the next 2 years, while 19% are considering adding or changing pharmacy vendors, and as few as 8% are considering both. About half (49%) are looking at external utilization management (UM) vendors to manage certain drug classes (e.g., GLP-1s for weight loss). Equal numbers of respondents (34%) are considering:

- negotiating new terms and rates with their existing PBM, such as cost trend guarantees

- implementing a transparent PBM model that includes a cost trend guarantee

- implementing patient decision-support tools based on cost or clinical differentiators

3. Employee experience

Employers in the study indicated general aversion to member disruption, perhaps explaining the apparent reluctance to PBM change. “Even minor adjustments (to the pharmacy benefit) can have significant financial and clinical impacts,” one respondent said, namely drugs no longer being covered or at higher contracted prices.

Another benefits leader suggested the disruption fear may be overstated depending on the type of changes made: “Employers worry about member disruption but having talked to employer clients of transparent PBMs myself, this seems like a non-factor. As long as employers communicate appropriately and explain their philosophy behind the decision, members seem to understand.”

The EHIR research touched on employer efforts to optimize the pharmacy benefit at both the plan and member level. At either, the report stressed the importance of ongoing support for plan members, especially those with chronic conditions. This includes guiding them to the right drugs based on both cost and clinical outcome.

Natasha Coult, Associate Principal, EHIR Advisory Services, summarized in her introduction to the report: “If a medication is not appropriate, is not working, is not being taken, or is causing harmful side effects, (then) formulary status, rebates, and UM controls are irrelevant.”

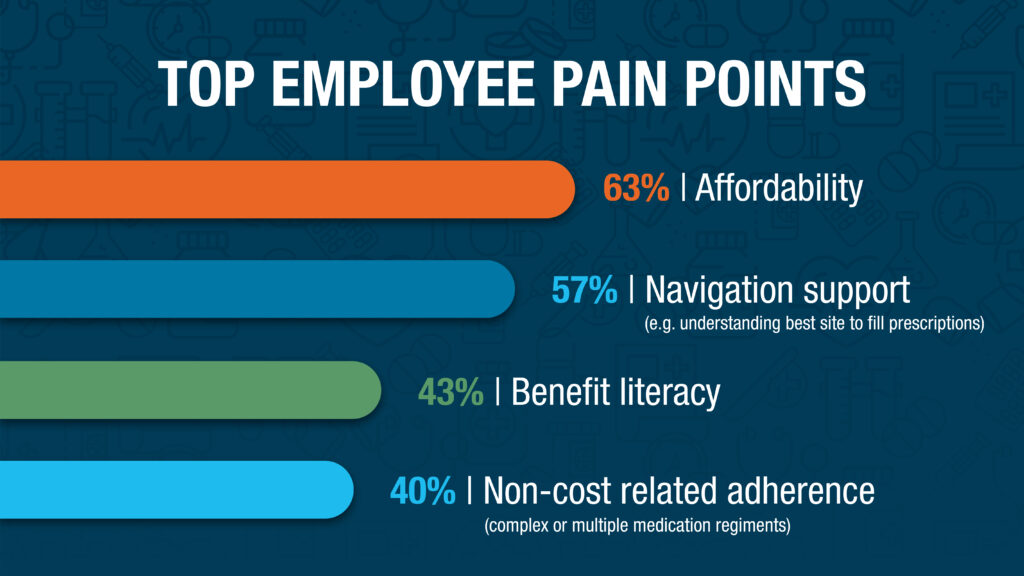

4. Employee out-of-pocket cost

Ranking it fourth in priority doesn’t mean respondents are insensitive to OOP expense. In fact, they named affordability the top employee pain point in their respective pharmacy benefits.

Comments in the report suggest the same limitations hampering employers’ ability to contain plan spend also pertain to members.

Since a plan’s negotiated pricing and rebate agreements are typically not transparent, members often are unaware of actual prices and discounts available for their prescriptions. Similarly, they (and often their providers) lack clarity on the cost variation between clinically effective alternatives as well as different pharmacies and fulfillment channels, all of which can drive significant differences in costs for the patient.

5. Drug price transparency

Overall, respondents repeatedly called out the need for greater transparency in the pharmacy benefits industry.

One benefits leader reiterated the desire to “know exactly what we’re paying, just like we do with our ASO medical contracts. Promoting transparency and reducing the complexity of managing pharmacy benefits would promote more aligned incentives, and ultimately better serve the goal of getting members on the right drug and the right time.”

Another described why their company is pushing to make an impact: “Even as a relatively small employer, we want to be at the forefront of driving change in the PBM industry because our double-digit cost trend is unsustainable. Traditional PBMs don’t provide enough transparency into the drivers behind that trend.”

A key takeaway from the report is that the push for change is gaining momentum, and it seems destined to come in the form of a “right drug, right time” approach, containing costs by focusing on outcomes. If employers aren’t getting the tools they need to support such an approach, they will look to other vendors or demand more from current ones.

“To help employers make changes to their pharmacy benefit management, innovators in the space need to explicitly call out metrics that differentiate them from traditional players … Employers need to have clarity around the financial impact these innovators would have, otherwise it’s really hard to make a change.”

Want more insights from these exclusive EHIR members?

About EHIR

- An invitation-only community of leaders from Fortune 500 companies looking to stay ahead of the curve amid a rapidly changing competitive landscape.

- More than a dozen Innovation Roundtable members are RxSS clients.

RxSS has been an EHIR Alumni Innovator since 2018, a select group of health tech vendors voted by member companies to present before Innovation Roundtables.